Bookkeeping, Accounting, and Auditing Clerks : Occupational Outlook Handbook : U.S. Bureau of Labor Statistics

It is essential for businesses, but is also useful for individuals and non-profit organisations. Bookkeeping provides the information from which accounts are prepared. It is a distinct process, that occurs within the broader scope of accounting.

When you assign a transaction to one account, the software automatically knows what else is affected and records it too. At the end of each financial year, all UK businesses, from limited companies to sole traders, are required to submit to HMRC annual trading accounts showing an operating profit or loss.

Acme & Associates is a growing novelty store. To ensure better maintenance of their financial records, they recently hired a Bookkeeper, Brenda, and an Accountant, Ann.

He or she must also find out whether any loans were required for the new purchase and how much cash was paid for the transfer. A skilled and compliant bookkeeper should be able to produce financial records that give business accurate information about its financial activities. These records are critical to the future success of any business. Not only are these records necessary for the business, they are also required by law.

It’s especially important to make sure that you’re doing it accurately, and that you work with professionals when you don’t understand certain things or the workload becomes too much. This bookkeeping system refers to a set of rules to record financial information where every transaction must impact at least two different accounts. A more complicated bookkeeping system found within developed software like QuickBooks or Xero which online accounting includes cash books, accounts payable and receivable, tracking of loans, inventory, payroll, journal entries, ledgers and trial balances. Accounting is the pulling together of the bookkeeping results by an Accountant into standardized annual financial statements. These are not usually required for sole proprietorships or sole traders unless you want to borrow money – the lender may want to see a proper set of accounts.

In a lot of ways, accounting is how we measure the economy at large. Accounting is the practice of analyzing, interpreting, and summarizing a business’ financial data. If bookkeeping is the recording, then accounting is the reporting, taking the ledgers and turning them into meaningful business information. Businesses that fail to keep track of their finances as their company scales are the same businesses that fail due to poor cash flow management. The most successful businesses utilize their bookkeeping as a tool to drive sales, marketing and set financial benchmarks.

Liabilities are those things the company owes such as what they owe to their suppliers (accounts payable), bank and business loans, mortgages, and any other debt on the books. Equity is the ownership a business owner, and any investors have in the firm.

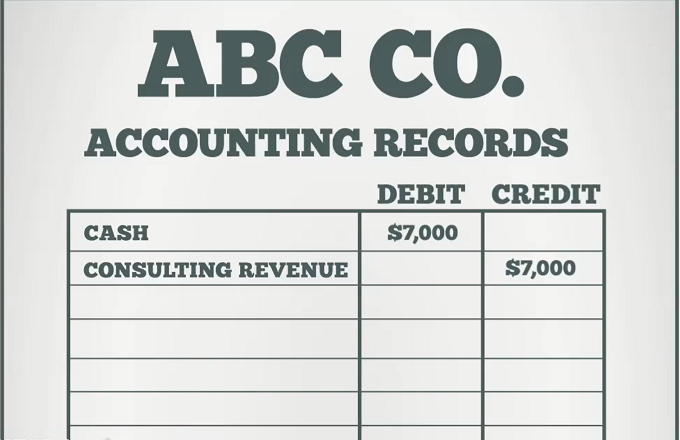

A sole proprietor or bookkeeper needs to know how to enter all the day to day financial transactions into the bookkeeping system. If you are going to offer your customers credit or if you are going to request credit from your suppliers, then you have to use an accrual accounting system. Using accrual accounting, you record purchases or sales immediately, even if the cash doesn’t change hands until a later time, such as in the case of Accounts Payable or Accounts Receivable. If your company is of any size and complexity, you will want to set up a double-entry bookkeeping system. Two entries, at least, are made for each transaction.

For example, imagine that you’ve just purchased a new point-of-sale system for your retail business. You paid for the system, which cost $2,000, bookkeeping in cash. Double-entry bookkeeping is definitely more challenging than single-entry bookkeeping, but don’t let the difficulty deter you.

Accuracy is the most vital part of the bookkeeping process. Bookkeeping is a necessity to all business and can be done using the single-entry or double-entry type in manual spreadsheets or automated software. The minimum requirement that a business must have is a cash book (which reflects the bank account activities of receipts and payments) and many small businesses can what are retained earnings stick with just a cashbook to do their bookkeeping. Experienced Accountants are well trained and knowledgeable in the country’s tax laws and accounting standards and can tweak the business accounts prepared by the bookkeeper to get the best tax advantages within a legal framework. Here are a few examples of business activities that result in financial transactions.

Vital for any company, no matter how big or small, it’s important to understand the ins and outs of the concept. Once you notice that your company is experiencing significant growth, you might not be able to deal with bookkeeping by yourself.

- While some companies elect to have both an accountant and a bookkeeper, the reality is that an accountant generally possesses the skills to do both.

- Bookkeeping, accounting, and auditing clerks produce financial records for organizations.

- All people who earn money from their self-employed activities and who operate as sole proprietors are “in business” and need to have a good bookkeeping system of some sort to track their finances.

- Whether it’s through the use of accounting software or utilizing bookkeeping services, maintaining a consistent and accurate bookkeeping system is critical in understanding the state of your company’s finances.

- Based on the records compiled by a bookkeeper, an accountant will create reports from recorded financial transactions that are required by government agencies and other bodies, and will formally file those accounts by the appropriate deadline.

- These platforms often work by using a laborious double-entry system that validates both the debit part (taking money from one account) and credit part (depositing it into another account) of the transaction.

Professional self-employed bookkeepers would do well for themselves to take on a strong consulting and specialist advisory role to their clients, stuff that a machine cannot do, because the day to day time intensive bookkeeping recording is going to eventually be all done by machine. Cash books are typically only for the cash basis of accounting. The most basic of bookkeeping records should enable people to see all the income earned and all the expenses paid resulting in a difference (income minus expenses) for a period of time like one month or the whole year. These reports should be easy to read and understand so that anyone in business can pick up one up and quickly interpret how well or not the business is doing, hence the need for national accounting standards (more on this below) so that every report has a similar layout with the same types of accounts.

If you are self-employed and it is a one-person business, you will do it yourself. If you are hiring staff and anticipate a lot of growth, you may hire a controller to handle your financial management and accounting.

In the normal course of business, a document is produced each time a transaction occurs. Sales and purchases usually have invoices or receipts. Deposit slips are produced when lodgements (deposits) are made to a bank account.

Costs also called cost of goods sold, is all the money a business spends to buy or manufacture the goods or services it sells to its customers. The Purchases account tracks goods purchased. Expenses are all the money online bookkeeping that is spent to run the company that is not specifically related to a product or service sold. An example of an expense account is Salaries and Wages. The controller is actually a company’s chief accounting officer.

Balance sheet. This document summarizes your business’s assets, retained earnings liabilities, and equity at a single period of time.

2. Double-entry bookkeeping

Hire an in-house bookkeeper, which can be extremely advantageous for a company. Having a daily meeting with a bookkeeper allows you to visualize the state of your company’s finances and can influence the decisions you make on a day-to-day basis. This can help with setting sales goals, analyzing how many clients you have and identifying financial trends. Although it may prove costly, many business owners pay the cost since they understand how much value a bookkeeper can bring to a company.

What is bookkeeping?

In the United States, businesses listed on the stock exchange must file regular financial statements according to GAAP. Why so heavily regulated?

Some businesses still use this method. A double-entry system involves turning each transaction into a debit and credit. It’s ideal for companies that collect income through accounts receivable, and receive merchandise or inventory on a credit-based system.

Each column in a journal normally corresponds to an account. In the single entry system, each transaction is recorded only once. Most individuals who balance their check-book each month are using such a system, and most personal-finance software follows this approach.